COVID-19 & Cannabis

Slowing the spread of the virus:

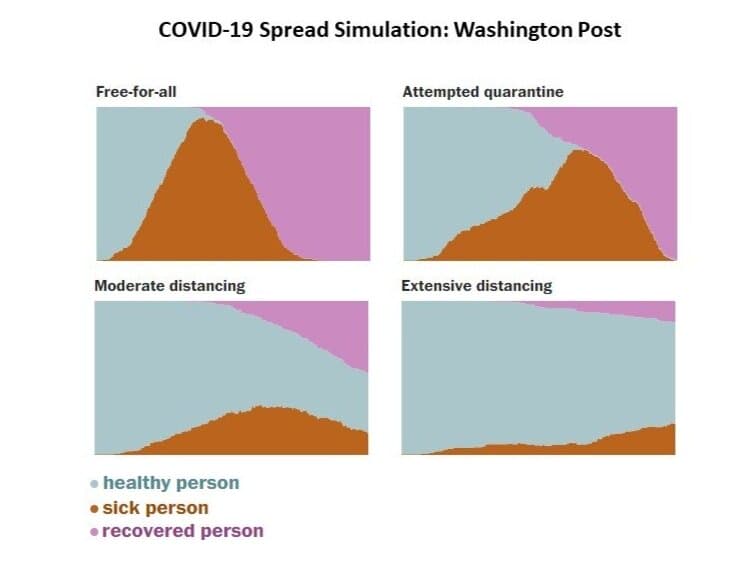

Each of us individually must practice ‘social distancing’ in order to slow the rate of infection so that the number of people who need hospital services does not reach a level that overwhelms the US healthcare system. When we boil it all down, too many people going to the hospital at the same time is the core systemic risk the nation faces today. ‘Flattening the curve’ requires everyone’s cooperation regardless of age or risk level and the actions we take today will have a direct effect on the number of lives lost to the pandemic. There is a lot of information floating around about the virus which varies drastically, making it difficult to know what to believe versus what has been exaggerated by the media to create headlines. We found the article, “A COVID-19 coronavirus update from concerned physicians”, to be an objective, unbiased and scientifically accurate article compared to some other information we’ve read to date.

The aforementioned articles give us comfort that while COVID-19 is a real threat and will certainly cause damage in several forms, together we can push past it successfully as long as the correct steps are taken by both the government and each of us individually. Given the recent travel bans, large-crowd event cancellations, and work-from-home policies put into effect over the past few weeks, we are confident that individuals and organizations across the U.S. understand the seriousness of the situation and are taking the necessary steps to help minimize the future damage from the virus.

How the virus could affect the private cannabis markets:

Public market volatility is off the charts today and many investors are seeking liquidity. It is our job as private markets investment managers to keep cool heads in the face of uncertainty, analyze situations objectively and make decisions that are in the best interests of our clients over the long-term. Below are five key points summarizing how we believe the spread of COVID-19 and subsequent economic slowdown may affect the private cannabis markets:

- Private cannabis companies who have raised capital recently and have cash on their balance sheets should be in good position to weather the storm. On the other hand, private cannabis companies who are in the process of fundraising or had plans to do so in 2020 will likely struggle to raise capital. Some of these companies will run out of cash and become distressed, making them acquisition targets for their competition or for opportunistic investors (further enabling investors to drive exceptional terms). We urge cannabis executives to prepare for a rocky couple quarters by identifying what costs are non-essential to their core business and can be pushed down the road until visibility is clearer.

- As investors face uncertainty associated with the spread of COVID-19, they are less likely to invest in early stage cannabis companies. We believe investment managers with dry powder may ultimately benefit from such an environment since capital dedicated to cannabis investments will become more scarce. This will enable investors with dedicated pools of cannabis capital to drive more favorable terms and valuations since their capital is in higher demand.

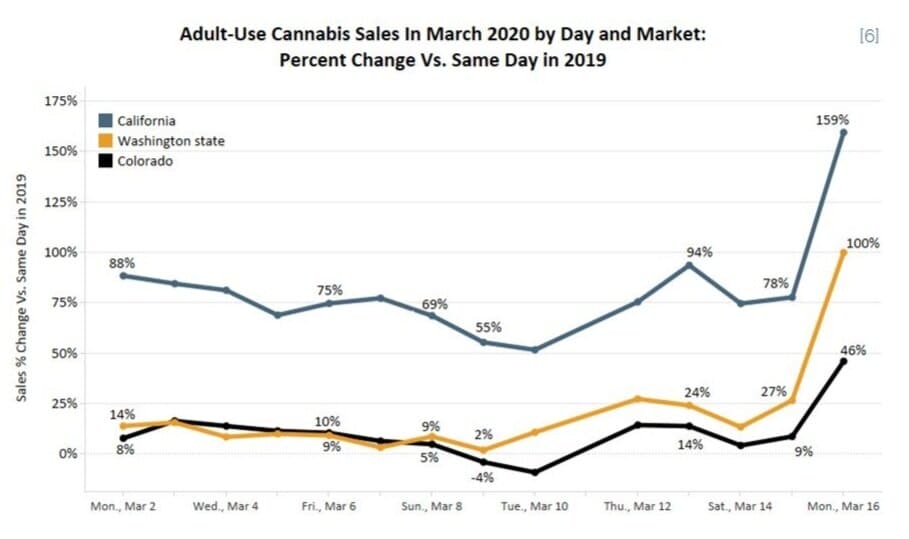

- Vice industries will remain an effective shield from market downturns. Compared to other asset classes we expect the cannabis industry to be relatively recession resilient (especially considering the pent-up demand in the black market, which is estimated at nearly 10x the legal market). Since the COVID-19 outbreak we have seen an uptick in cannabis sales, particularly delivery sales, as people use cannabis to cope with mounting anxiety around the pandemic and create a stockpiles of products out of fear that dispensaries will run out [1]. While cannabis has never been legal during a US recession, we can look at alcohol as an example to understand how vice industries perform in recessionary environments – research has shown that although consumers tend to spend less in total dollars on alcohol and other vices during a recession, the quantity tends to increase as people buy more of less-expensive products [2]. According to financial information company Sageworks, alcoholic beverage sales grew by 10% in the U.S. in the trailing 12-month period between June 1, 2010, and May 31, 2011 [3]. This period, following the steepest recession in seven decades, featured an average unemployment rate of 9.3%.

- An economic slowdown could make cannabis legalization at the federal and state level more attractive as budgets become tighter due to decreasing tax revenues. There is an argument to be made that federal and state legislatures that were previously ‘on the fence’ regarding cannabis legalization may now proactively push for it as a means to make up for the decrease in tax revenues caused by the slowing economy.

- The vast majority of economists predict the U.S. will start to rebound later in the year, though they are split over how soon and how fast. Some economists see a rapid recovery starting as early as summer with help from government stimulus [4]. Given the strength of the cannabis consumer, we expect the cannabis companies who can weather the storm today to continue on their rapid growth trajectories once the pandemic is under control.

The bottom line is that cash is king today – cannabis companies who have strong balance sheets will weather the storm and investment managers with dry powder will be in a position to deploy capital in opportunities that wouldn’t have otherwise existed if a surging bull market were to have continued. The cannabis consumer remains strong – global legal cannabis spending grew 46% YoY from 2018 to 2019 and while, in light of recent events, we don’t expect the same YoY growth from 2019 to 2020, we certainly still expect cannabis consumer spending to grow significantly.

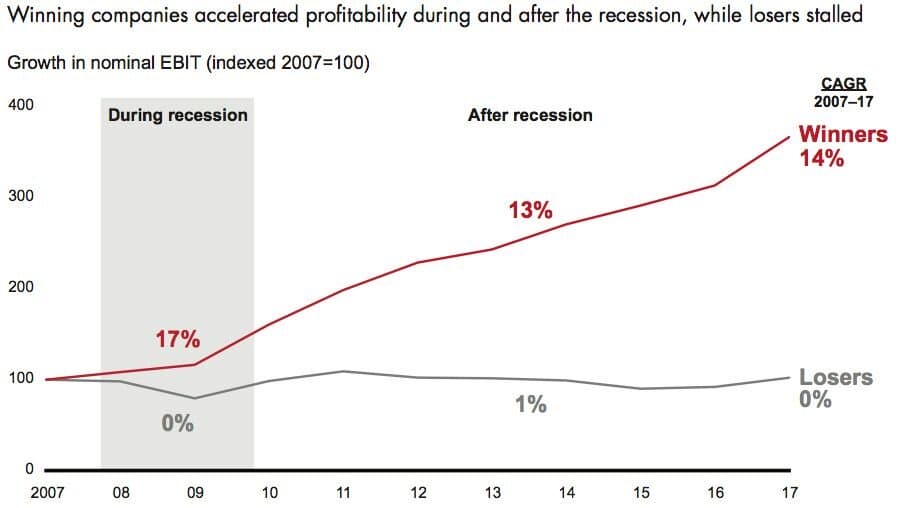

How ‘winning’ companies act in a downturn:

A study by Bain & Company analyzed the financial performance of more than 5,000 companies over a ten year period including the global financial crisis, and found that ‘winners’ grew at a 17% compound annual growth rate (CAGR) during the downturn, compared with 0% among the losers. What’s more, the winners locked in gains to grow at an average 13% CAGR in the years after the downturn, while the losers stalled at 1% [5].

How did ‘winning’ companies in Bain’s study act shortly after and during a downturn?

- They did not heavily cut costs or reduce R&D – subsequently they did not lose top talent.

- They did not stray outside their core business to “find a way out” of a recession.

- They viewed cost management as a way to refuel the growth engine for the next stage in the business cycle.

- Management tightly managed cash, working capital and capital expenditures as a means to create “fuel” to invest throughout the cycle.

- Management divested non-core assets in order to further invest in their core business.

- They focused their sales efforts on top priorities and maintained marketing spend while their competitors cut back.

…some food for thought for cannabis companies currently revising their business plans.

Conclusion: in the midst of chaos, there is also opportunity:

History has shown us that in any market disruption, panic-induced decision making rarely benefits investors and that huge wealth is truly created after market downturns. While many investors will be too fearful of the current economic conditions to invest, we believe that those who have the confidence to deploy capital in cannabis investments today will benefit tremendously over the long term. After all, both Microsoft and Apple were founded in 1975 in a recessionary environment and the Apple we know today largely took off after the iPod was released as the dot-com bubble was bursting in 2001. Google and Salesforce also survived the dot-com bubble burst after being founded in 1999 and 1998 respectively. Uber was founded in 2009 shortly after the GFC and was worth $70 billion 5 years later…

Below are the reasons we believe cannabis investors in particular should look at the current state of the financial markets opportunistically, especially when compared to other industries.

- Cannabis is one of the fastest growing industries in America.

- The cannabis industry is likely to show more resilience to a recessionary environment than other industries since cannabis is a vice and vice industries typically perform well through market cycles.

- The cannabis industry was constrained for capital before COVID-19 and may be even more constrained for capital in a recessionary environment, enabling investors to drive better terms and valuations.

- We may see an increase in the rate that states legalize medical and recreational cannabis in an effort to make up for lost tax revenues.

- Mature U.S. companies could become even more reluctant to expand into the cannabis space in a recessionary environment as they will be forced to focus on their core business, reducing competition for early-stage cannabis companies.

At KEY we will continue to focus on finding high quality cannabis companies backed by exceptional management teams and will provide them the capital they need for long-term sustainable growth. We continue to believe, regardless of recent events, that the cannabis industry will grow at a rapid pace and that one day we will look back at this window in time as the beginning of a once-in-a-lifetime opportunity. While the market conditions have changed, the cannabis industry is still alive and well.

As Paul Graham, Co-Founder of Y Combinator, said in October 2008 shortly after the market crashed:

“Startups generally need to raise some amount of external funding, and investors tend to be less willing to invest in bad times. They shouldn’t be. Everyone knows you’re supposed to buy when times are bad and sell when times are good. But of course, what makes investing so counterintuitive is that in equity markets, good times are defined as everyone thinking it’s time to buy. You have to be a contrarian to be correct, and by definition only a minority of investors can be. So just as investors in 1999 were tripping over one another trying to buy into lousy startups, investors in 2009 will presumably be reluctant to invest even in good ones.”

We wish everyone and their families safety and good health as we push through this challenging time together!

Sources

[1] Bartlett, Lindsey. “Coronavirus Spikes Demand For Cannabis Delivery As People Stockpile Products.” GreenEntrepreneur. GreenEntrepreneur, March 13, 2020. https://www.greenentrepreneur.com/article/347533.

[2] Rosenberg, Eric. “5 Recession Resistant Industries.” Investopedia. Investopedia, January 29, 2020. https://www.investopedia.com/articles/investing/100115/5-recession-resistant-industries.asp.

[3] Smith, Aaron. “Alcohol Sales Thrive in Hard Times.” CNNMoney. Cable News Network, June 9, 2011. https://money.cnn.com/2011/06/08/news/companies/alcohol_sales/index.htm.

[4] Bartash, Jeffry. “The Economy Is in for Tough Times, but Here’s a Roadmap for Recovery from the Coronavirus.” MarketWatch. MarketWatch, March 14, 2020. https://www.marketwatch.com/story/the-economy-is-in-for-tough-times-but-heres-a-roadmap-for-recovery-from-the-coronavirus-2020-03-13.

[5] Consultancy.eu. “Strategies to Win during an Economic Recession.” Consultancy.eu. Consultancy.eu, October 31, 2019. https://www.consultancy.eu/news/3402/strategies-to-win-during-an-economic-recession.

[6] Schaneman, Bart, and Eli McVey. “Recreational Cannabis Retailers’ Sales Surge during Coronavirus Pandemic.” Marijuana Business Daily, March 18, 2020. https://mjbizdaily.com/recreational-cannabis-retailers-sales-surge-during-coronavirus-pandemic/?utm_medium=email&utm_source=newsletter&utm_campaign=MJD_20200318_News_Daily.

DISCLAIMERS: This site is not intended to provide any investment, financial, legal, regulatory, accounting, tax or similar advice, and nothing on this site should be construed as a recommendation by Key Investment Partners LLC, its affiliates, or any third party, to acquire or dispose of any investment or security, or to engage in any investment strategy or transaction. An investment in any strategy involves a high degree of risk and there is always the possibility of loss, including the loss of principal. Nothing in this site may be considered as an offer or solicitation to purchase or sell securities or other services.