What Investors Can Learn from the Dot-Com Boom

In the late 1990s, hot tech stocks achieved massive valuations that look ludicrous today with the benefit of hindsight. Companies like eToys, WebVan, and Pets.com achieved respective market caps of $10.3bn, $10.9bn and $369m despite never exceeding cumulative net sales of $364mn, $271mn, and $34mn. Those valuations came crashing down starting in March 2000 when the bubble burst (all three subsequently filed for bankruptcy).

However, the story was not all bad for tech in the late nineties. Jeff Bezos founded Amazon in 1994, Larry Page & Sergey Brin founded Google in 1998, and Steve Jobs returned as CEO of Apple in 1997. As of March 20, 2019, those companies had respective market caps of $870.6bn, $840.1bn and $881.6bn as well as LTM revenues of $232.9bn, $136.8bn, $261.6bn. Investors were right to believe in the future growth of the industry, but many were blinded by the hype and misplaced their capital in the wrong places. We believe a similar situation has developed in the cannabis industry today.

In 2018, the legal cannabis industry generated over $12bn of revenues. That figure is projected to grow to $57bn by 2027—close to five times market growth—and investors have taken notice. Hardly a day goes by where names like Canopy Growth, Tilray, Aurora and Cronos aren’t in CNBC’s headlines. These Canadian licensed producers (“LPs”) now command massive valuations as publicly traded companies. But are these valuations justified today? Let’s look at their market caps as a multiple of 2018, 2019 and 2020 projected revenues:

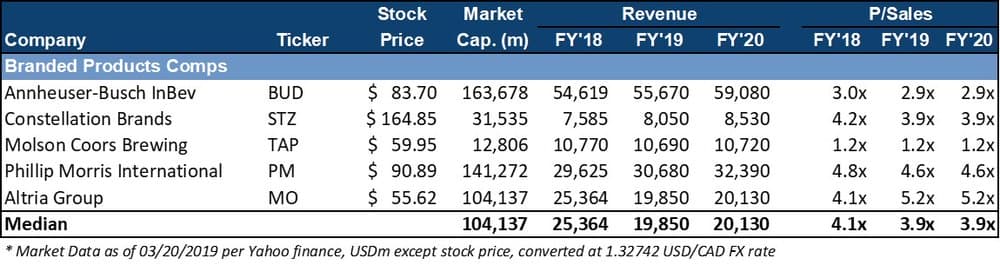

Now let’s compare them to the valuations of established alcohol and tobacco companies relative to their multiples and projected revenues:

As the above tables illustrate, these Canadian LPs have massive growth already priced into their valuations. In the case of Canopy Growth, its market cap already exceeds that of Molson Coors despite having 1/183rd as many revenues. Our view is that many investors are choosing to buy shares in these LPs based on pure speculation rather than on fundamental analysis, which could be creating a valuation bubble in the public cannabis market like the one tech experienced in the late 1990s. So where is the smart money positioned?

In the best of cases, public cannabis companies will turn the cash they’ve raised from public equity issuances into a self-fulfilling prophecy, using that cash for accretive growth projects and M&A. However, many of these companies will be unable to execute as needed and their valuations will inevitably revert to reflect that inability.

The point of this analysis is not to recommend buying or selling specific securities, but rather to caution investors to seek out the cannabis companies that are best positioned for long-term, sustainable growth and whose valuations today remain rational. In the case of emerging industries like tech in the nineties or cannabis today, fundamentals are paramount, which is why investors should place the utmost importance on investing in quality management teams — and not simply chasing the latest sensational growth patterns or headlines like many retail or DIY investors.

DISCLAIMERS: This site is not intended to provide any investment, financial, legal, regulatory, accounting, tax or similar advice, and nothing on this site should be construed as a recommendation by Key Investment Partners LLC, its affiliates, or any third party, to acquire or dispose of any investment or security, or to engage in any investment strategy or transaction. An investment in any strategy involves a high degree of risk and there is always the possibility of loss, including the loss of principal. Nothing in this site may be considered as an offer or solicitation to purchase or sell securities or other services.